Kalgera

Providing trusted informal care-givers of older people view-only access to their loved one’s financial accounts in an easy and secure way.

Headquarters address

Kalgera means good old-age in ancient greek. Kalgera provides an easy and secure way for close relatives and care-givers of older people to obtain view-only access to their loved ones’ financial accounts. The insight gained will help the over 3 million care-givers in the UK that currently help with money management to secure their loved ones against avoidable financial losses.

Kalgera is the brainchild of Founder and CEO Dr Dexter Penn who developed the vision for Kalgera while working as an NHS doctor in Neurology. He he noticed that his older patients and their relatives often had difficulty co-managing money. There are 11.6 million individuals aged 65 or older in the UK with 6% growth annually. Many older people live on the edge of losing their independence and 130,000 were victims of fraud in 2015. There are 6.5 million informal care-givers in the UK with 49% of them assisting with money management for their loved one.

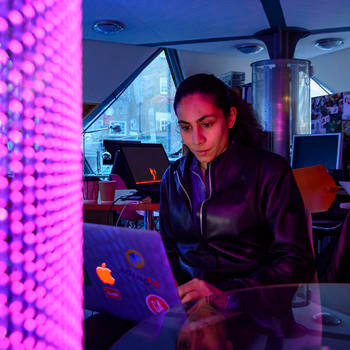

Dr Penn met Co-Founder and COO Ivona Wolff via a mutual contact in the Ageing space and immediately clicked. Ivona has a decade of experience in the financial services sector, particularly retail banking and payments and is intimately familiar with current and forthcoming regulatory requirements. Together they assembled the team and fine-tuned the business plan and started developing partnerships with stakeholders and secured pre-seed investment.

Kalgera will:

- Provide a secure, auditable platform for money co-management between older people and their carers.

- Aggregate “read only” transaction data from multiple financial accounts.

- Provide intelligent data synthesis that allows spending comparison and reminds users of important actions required (e.g. switch to a cheaper utility tariff on end date) to save money.

- Deliver a truly age-friendly design that makes personal finance more inclusive.

- Develop a machine learning technique to identify signs of mild cognitive impairment based on financial behaviour.

Tech stack